Governance

Oops

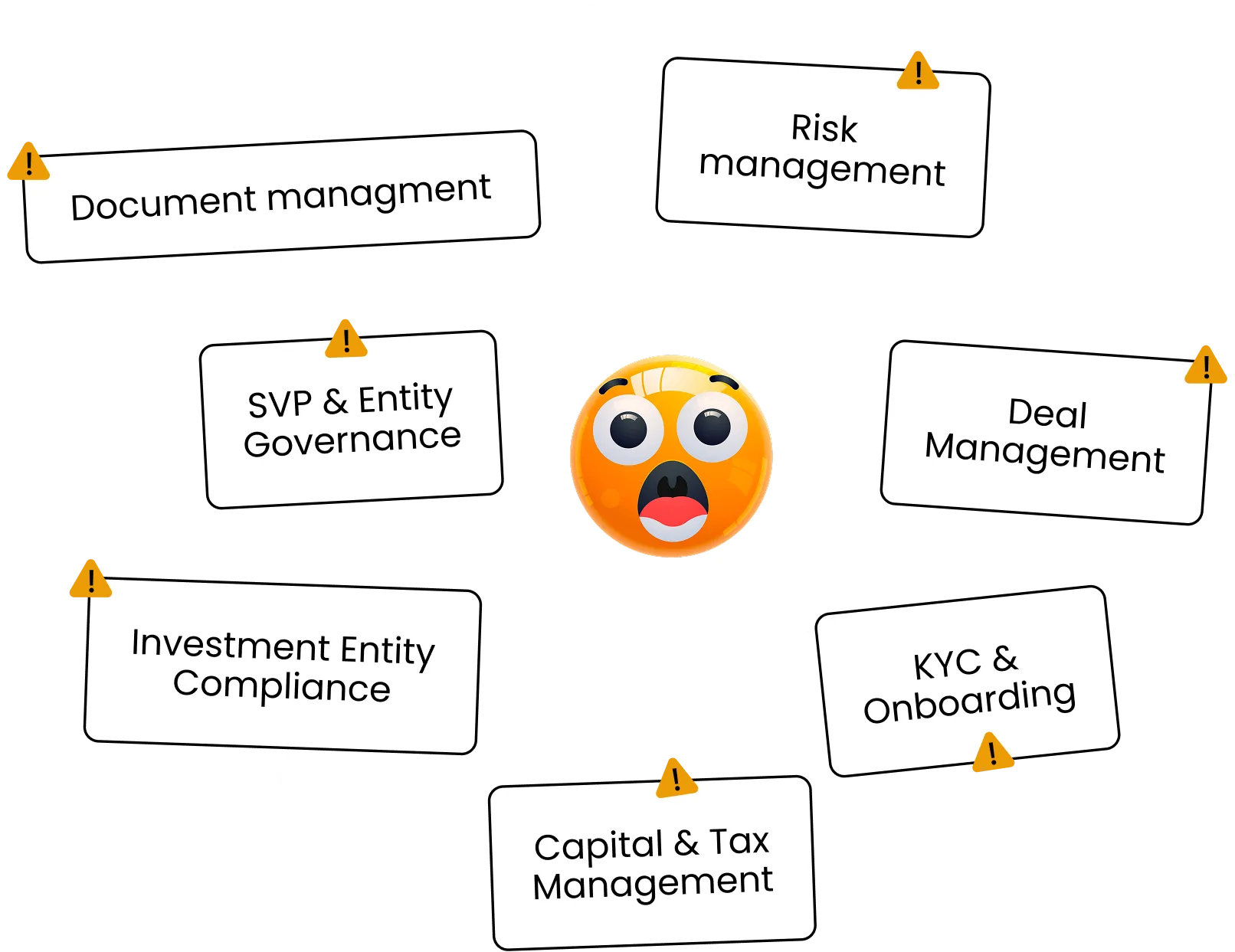

When administrative actions turn into real risk

Legacy entity management systems aren’t

just outdated —

They’re Risky

For too long organizations have treated entity and governance management as back-office admin work: painful, but harmless. In reality, legacy systems and disconnected workflows create blind spots that expose companies to real material risk.

Missed filings, midfield records and invisible ownership stakes don’t just cause friction. They can trigger regulatory penalties, blow up deals and damage reputations. That’s a governance oops. And it’s more common than most teams realize.

What Is A Governance Oops?

A governance oops is the moment when an overlooked compliance task, buried spreadsheet or missed deadline creates a material risk with real business consequences.

It could be a forgotten filing that gets an entity struck off the registry. Or a hidden preferred equity instrument that results in a $180M write-down.

Regardless of the reason or cost, these aren’t one-off blunders. They’re symptoms of a bigger issue: siloed teams, fragmented systems and outdated approaches to entity and governance management.

Real

Oops Moments

The $180M Oversight

A global PE firm discovered a forgotten preferred equity instrument during an audit. The result? A $180 million adjustment to returns, all because one piece of the capital structure was buried in disconnected spreadsheets.

IPO Blocked By A Missed Filing

A multinational corporation had an overseas entity quietly struck off due to a missed annual filing. Unfortunately, that entity held 40% of global assets, and the delisting occurred one quarter before a planned IPO.

UBO Misfire

An international bank misrecorded the Ultimate Beneficial Owner of a subsidiary. The mistake was only discovered during a regulatory review, triggering urgent corrections and reputational damage.

Unaligned Team Vs Litigation

A global developer’s tax team dissolved inactive entities to cut costs — not realizing they were named in US litigation. The legal team wasn’t in the loop.

Missed Board Filings

A manufacturing firm submitted board reports based on outdated entity information. The result? Non-compliant actions, emergency remediation and senior leadership changes.

The $180M Oversight

The oversight emerged when external auditors questioned discrepancies in the reported equity values, revealing that an unrecorded preferred equity instrument had been omitted from financial disclosures over multiple reporting periods. This discovery led to a cascade of corrections, significantly impacting investor confidence and triggering extensive internal reviews.

The incident highlighted critical vulnerabilities within the company’s manual record-keeping processes and prompted a reevaluation of internal controls and data management.

IPO Blocked By A Missed Filing

The missed filings remained unnoticed due to fragmented oversight between local and global teams, causing the entities’ legal status to lapse unexpectedly. The resulting administrative dissolution halted the IPO, delaying market entry and eroding investor trust.

Recovery involved significant legal and financial resources to reinstate the entity and regain regulatory approval, underscoring the costly consequences of overlooked administrative diligence.

UBO Misfire

The misidentification occurred due to conflicting records between holding entities, resulting in an incorrect UBO designation during a routing KYC audit.

When regulators uncovered the discrepancy, the bank faced intensified scrutiny, corrective actions and reputational repercussions. This highlighted severe weaknesses in governance transparency, ultimately prompting an overhaul of compliance protocols to ensure data accuracy.

Unaligned Team Vs Litigation

The lack of communication between tax and legal departments — and absence of an active legal hold process — meant the tax team unknowingly eliminated entities involved in ongoing litigation procedures. The oversight resulted in an immediate $5 million fine and forced them into a painstaking and lengthy process of reinstating each entity.

This governance gap exposed the risks of departmental silos and underscored the need for cross-functional alignment and transparency.

Missed Board Filings

The outdated entity records provided to the board were a direct result of fragmented and decentralized data management. Board decisions based on incorrect entity information were later deemed non-compliant, triggering regulatory penalties and damaging executive credibility. The aftermath included leadership reshuffling and the implementation of a centralized governance framework that emphasized accurate, timely and unified entity information.

How Does Governance

Oops Happen?

Mistakes like these don’t happen out of the blue. They build up quietly, in the background, a cumulative effect of the established, everyday behaviors and workflows of typical entity management:

- Disconnected systems and siloed departments

- Manual processes and fragile workflows

- Governance data scattered across emails, spreadsheets and ineffective tools

- A lack of shared visibility between legal, finance, compliance and tax

In complex organizations of all sizes, these issues are not just common, they’re standard practice. Teams are using the same disconnected tools and systems they’ve had for decades, and as the complexity of modern business increases, so do the risks of relying on outdated workflows.

From Oops

To Ops

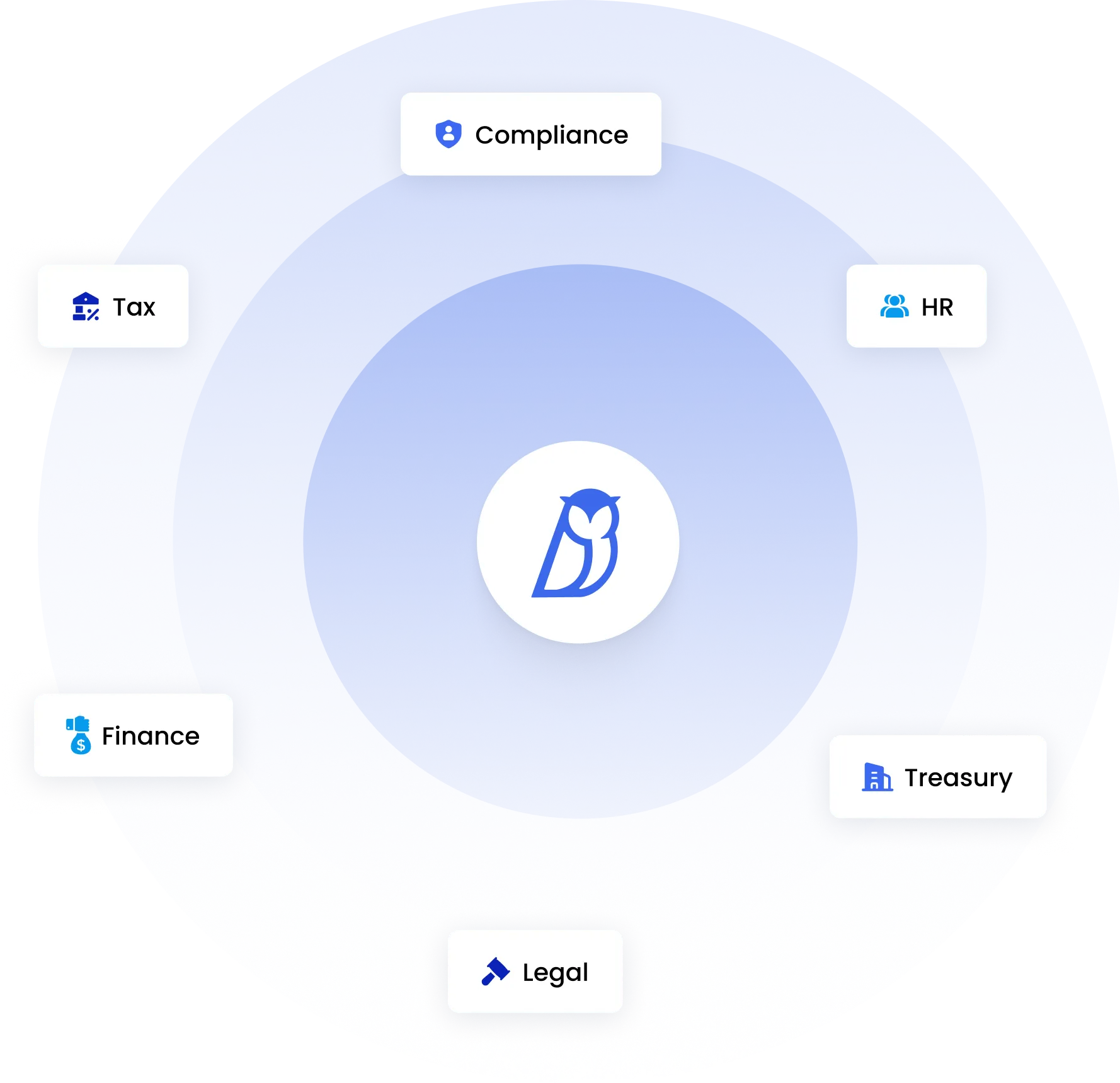

Thankfully today’s teams can move on from risky, outdated practices and avoid governance oops altogether — by moving to governance ops. The solution isn’t more vigilance or longer to-do lists: It’s a shift in mindset.

Governance ops is a modern approach that aligns legal, finance, tax and compliance teams through a single source of truth and operationalizes governance with intuitive, fully integrated tools for managing complex structures. It enables:

- Centralized, accurate governance data

- Proactive alerts and configurable access

- Automated workflows for filings and compliance

- Shared visibility across teams and jurisdictions

- Faster reporting, better decision-making, stronger investor confidence

Where legacy tools are reactive and fragmented, governance ops is proactive, connected and reliable.

Explore governance ops

Don’t Wait For An Oops

Build governance ops now. These stories may sound dramatic, but they’re more common than you think. Teams across jurisdictions and industries struggle with the same persistent issues:

- Lack of a centralized source of truth

- Fragmented technology and poor integration

- Cross-functional misalignment

- Manual processes prone to delay and error

- Complicated and siloed workflows

Why take the risk? Governance ops lets ambitious teams modernize governance, reduce exposure and stay deal-ready.

-p-500.webp)

-p-500.webp)

-p-500.webp)

.webp)